Many sports traders attempt to minimize risk by placing trades in related betting markets, thinking they are making smart hedging decisions. However, this approach is fundamentally flawed because it results in unnecessary commission payments and inefficient risk management.

The same mistake applies to traders who hedge in a different market rather than in the original one. The belief that covering positions in separate markets protects profits is false—it only reduces profitability. Let’s break this down with real examples.

Understanding Related Betting Markets

A related betting market is when two markets influence each other directly. Examples include:

Under 0.5 Goals vs. Correct Score 0-0

Under 1.5 Goals vs. Correct Score (0-0, 0-1, 1-0)

Lay the Draw vs. Correct Score (0-0, 1-1, 2-2, 3-3, AOD)

Many traders wrongly believe that by placing opposing bets in different markets, they are diversifying their risk. In reality, they are trading the same event twice while paying extra commission, making long-term profitability impossible.

The Hidden Cost of Related Betting Markets Trading

Example 1: Lay Under 0.5 Goals & Back 0-0

Let’s assume you:

Lay Under 0.5 Goals at odds of 17 for €100

If no goals are scored, you lose €1,600

If a goal is scored, you win €98 (€100 profit minus 2% commission)

Back Correct Score 0-0 at odds of 17 for €100

If no goals are scored, you win €1,568 (€1,600 minus 2% commission)

If a goal is scored, you lose €100

Comparing results:

If no goals are scored: You lose €32 (€1,568 win minus €1,600 loss)

If a goal is scored: You lose €2

Yes, this is a very basic example. But since you are paying commission twice and not actually reducing risk, you lose money in any scenario.

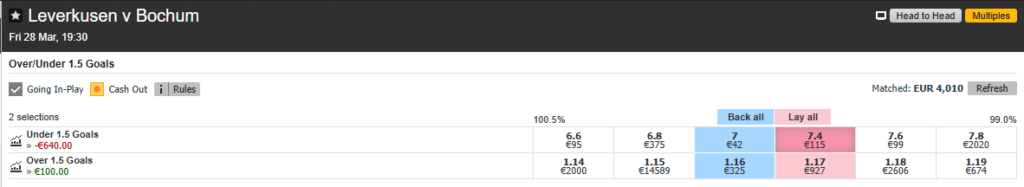

Example 2: Lay Under 1.5 & Back Correct Scores (0-0, 0-1, 1-0)

Some traders attempt to hedge by laying under 1.5 goals while backing the three most likely correct scores (0-0, 0-1, 1-0). However, this is the exact same bet, just split into multiple markets.

Again, Betfair charges commission separately on each market, eating into any potential profits.

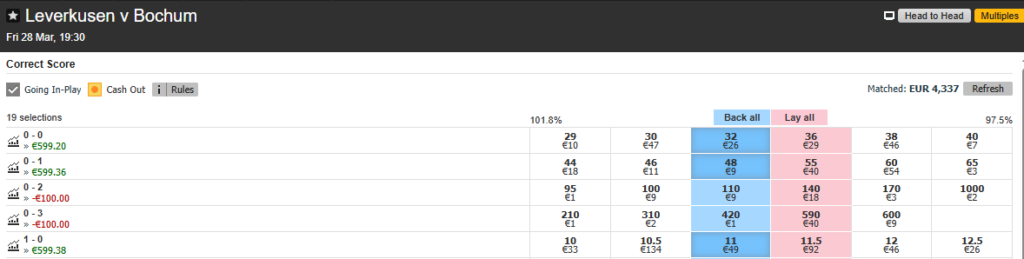

Example 3: Lay the Draw with Insurance on 0-0? Think Again!

One of the most common but flawed strategies is laying the draw and covering 0-0. The idea is that if a goal is scored, the lay trade profits, and if no goals are scored, the 0-0 bet covers the loss.

However, when you analyze the numbers, you realize that:

You are paying commission on both markets

The odds on 0-0 never match perfectly with the implied probability of the draw, creating a built-in loss

You gain no edge, only redistributing liability

Simply put, if someone advises you to trade this way, they either don’t understand betting exchanges or they have an ulterior motive.

Example 4: Hedging in a Different Market is the Same Mistake

Let’s say you place a pre-match bet on Under 2.5 Goals at odds of 1.90 for €100 in the Over/Under betting market.

By the 85th minute, the score is 1-1, but any additional goal will wipe out your profit. To hedge, you decide to:

Lay 1-1 at odds of 1.60 for €100 in the Correct Score market (this creates a €60 liability).

Now, let’s analyze the possible outcomes:

If the match ends 1-1:

Your original Under 2.5 Goals bet wins, earning €88.2 profit (€90 – 2% commission).

But your lay bet on 1-1 loses €60, leaving you with a final profit of €28.2.

✅ If you had hedged in the same market (Over/Under) for a €60 liability, your profit would have been €29.4 (90 – 60 = 30, minus 2% commission).

If another goal is scored (2-1, 1-2, etc.):

Your Under 2.5 Goals bet loses (-€100).

Your lay bet on 1-1 wins €98 (€100 – 2% commission).

Final result: €-2 loss.

✅ If you had hedged in the same market, you would have had 0 loss (100 – 100 = 0).

This proves that hedging in a different market is inefficient. Simple advice… stay in the same market.

The Right Approach to Football Trading

Rather than trading on related markets, focus on strategies where:

You capitalize on odds movement rather than hedging across correlated markets

You avoid double commission and inefficient bet placements

You look for true value, where odds are mispriced by the market

If you want to be a profitable trader, stop falling for “insurance” tricks that only benefit the exchange. Instead, refine your skills, analyze market movements, and develop a real edge.

Related Betting Markets - The Bottom Line

Trading on related betting markets or hedging in different markets is a mistake that reduces profitability in the long run. Many so-called “experts” who recommend these strategies either don’t understand betting exchanges or have hidden purposes.

To succeed in sports trading, focus on one sport/market/strategy and hedge efficiently within that same market. Don’t fall for the illusion of risk reduction when in reality, you’re just increasing costs.